See what's cooking at Tink

See what's cooking at Tink

See what's cooking at Tink

See what's cooking at Tink

Welcome to Tink,

a Visa solution

Payment services and data enrichment, trusted by world-leading businesses

Get started

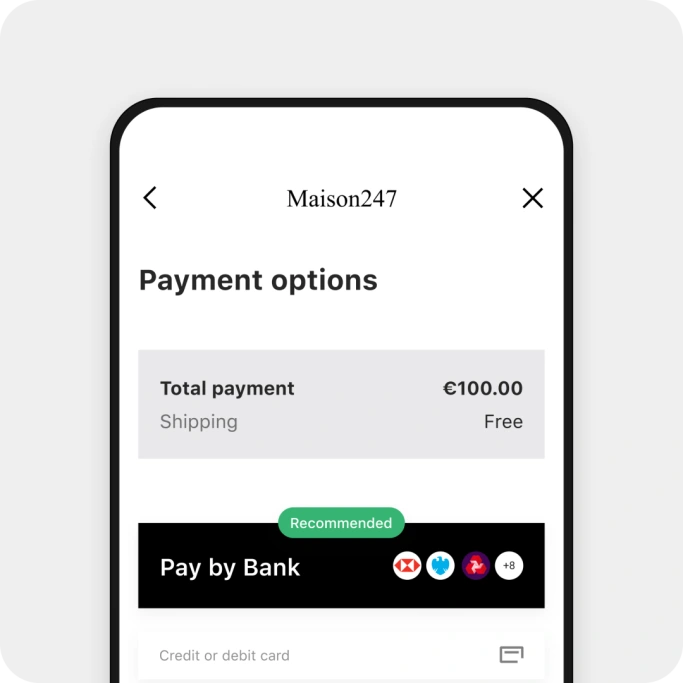

Pay by Bank

Reach more customers, increase conversion, and reduce costs with customisable account to account payment flows that can be easily embedded into any experience.

Learn more

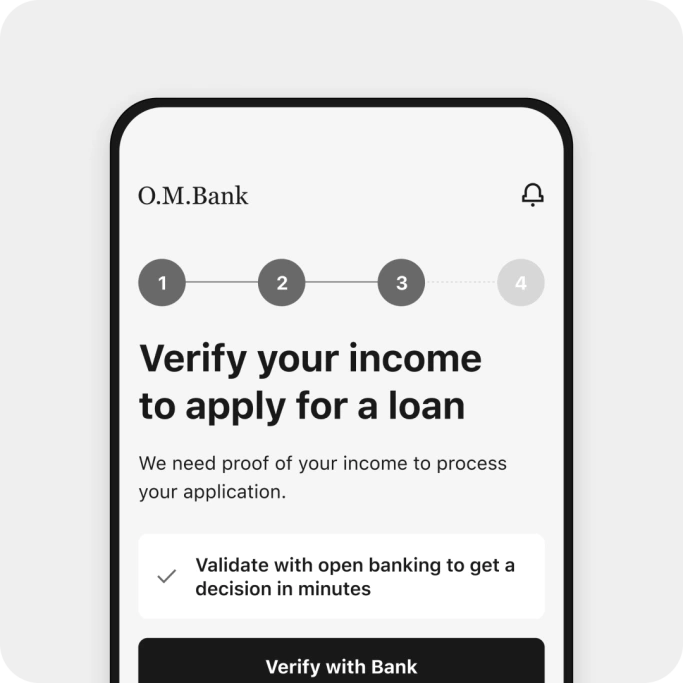

Risk decisioning

Improve credit risk decisions using transaction-based affordability assessments. Offer frictionless, inclusive application journeys for consumers.

Learn more

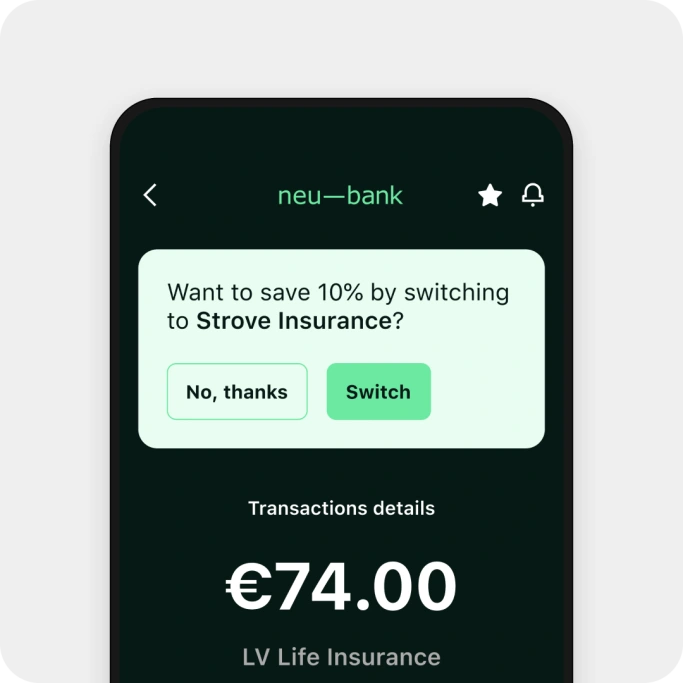

Consumer engagement

Enhance interaction and loyalty through your digital banking app by transforming transactional data into innovative and insightful financial tools.

Learn moreFor industry leaders

“Our aim is to always innovate to meet consumer needs by providing a breadth of convenient, fast, and secure payment options. Partnering with Tink for open banking is the latest way we have evolved our technology to deliver on this goal.”

Edgar Verschuur

Head of Global Acquiring at Adyen

“Responsible lending is all about granting the correct credit to the private individual that has the means to service the loan without compromising on other expenses. Tools such as those Tink provides for Bank Norwegian is an enabler of data that supports our philosophy as a provider of a pure digital customer journey.”

Peer Timo Andersen-Ulven

CRO at Bank Norwegian

“We’re very pleased to partner with Tink, the leading player in account-to-account payments. Today we handle hundreds of millions of invoices annually for customers in the Nordics. Open banking lets us expand our offering to now also include simple, compliant, and user-friendly payment solutions integrated in our existing channels.”

Mattias Norén

Head of Strategy at PostNord Strålfors

“Partnering with Tink was an important step in our ambition to improve the user experience, leveraging PSD2 to develop a simpler payment solution. Using Tink as a provider for our new payment service became a natural choice as we explored the market.”

Vesna Lindkvist

CTO at Kivra

“We are delighted to bring Tink’s solutions to Revolut. Our partnership with Tink will enable Revolut to expand our open banking services across new markets in a fast and sustainable way.”

Ivan Chalov

Head of Retail at Revolut

“With Tink we have provided our customers with a much smoother way to prove their income and their creditworthiness, which has helped us reduce our application processing time down to less than 10 mins. It has helped us increase our automated funnel which in turn increased approval rates, faster time to money, and reduced risk of fraud and uncompleted applications - all real difference makers for our growth.”

David Öhlund

CEO at GF Money

“Enabling people living in Ireland to replace financial worry with financial confidence is a key goal for An Post Money. We are thrilled to have partnered with Tink to enable not only An Post Money customers but everyone living in Ireland to have the ability to manage their money better, stay in control of their expenses and start building financial confidence.”

Bruce Richardson

Product Management Consultant at An Post

Tink offers an incredible amount of out-of-the-box products with basically unlimited possibilities for customisations and new innovations. The overall quality and uptime of their services has been great and we have had no issues at all, even with the enormous amount of new customers we’ve acquired in a short amount of time.

Andreas Norberg

Head of Innovation at Rocker

“By teaming up with Tink, we aim to give Lydia’s users the best possible experience and allow them to easily manage their financial daily lives within our app.”

Cyril Chiche

co-founder and CEO of Lydia

“At Tradera, we always aim to make the user experience as simple and friction-free as possible for our customers. For that reason, our partnership with Tink was a perfect fit for us.”

Stefan Öberg

CEO at Tradera

“Tink's open banking payment system is the obvious choice for our customers – it takes our already instant onboarding experience and adds easy, frictionless payments – enabling anyone to invest in their first crypto in less than two minutes.”

Jamie McNaught

CEO and co-founder at Solidi

“Tink was the obvious choice as a scalable and reliable partner to help make our product experience as simple and as user-friendly as possible.”

Tim Öhman Cirillo

COO at Billogram

“With Tink, it was very easy and smooth to get started. We understood perfectly when we read the documentation and the technical sections the first time and that was a big reason for us to choose Tink. The integration was very seamless and easy.”

Nanna Stranne

CEO and founder, Sigmastocks

“Working together with Tink means we can provide contextual money-saving insights and deliver a personalised, fast and accurate customer experience.”

John Natalizia

Cofounder and CEO at Snoop

“Open banking lets us deliver seamless payment experiences that are quicker and more competitive than traditional card payments. The customer response has been brilliant, and our partnership with Tink means we can maintain our market-leading low fees.”

Simon Holland

Chief Product Officer at Wealthify

Risk Insights

Start assessing creditworthiness with real time, up-to-date and verified data giving unique insights into spending behaviours.

Money Manager

Build smart, intuitive personal finance management applications that give your customers tools and personalised insights to better manage their money.

Payments

Increase engagement and conversion by giving your customers a fully embedded payments experience – at a fraction of the cost.

Variable Recurring Payments

Smarter, faster recurring payments. VRPs are the new way to enable frictionless, real-time open banking payments.

Risk Signals

Increase settlement rates, prevent fraud, and unlock faster payments with risk tools built for account-to-account payments.

Account Check

Confirm account ownership with real-time data straight from a user’s bank account, creating a quick and simple payment setup process.

Business Account Check

Instantly verify business account ownership with data straight from banks for quick and easy merchant onboarding, payouts or direct debit setup.

Transactions

Get real-time transaction data - straight from banks, and delivered in a standardised format.

Business Transactions

Get real-time transaction data from business accounts – straight from banks, and delivered in a standardised format.

Investments

Confirm account ownership with real-time data straight from a user’s investment bank account, creating a quick and seamless onboarding process

Loans

Confirm loan account ownership with real-time data straight from a user’s loan account, creating a quick and seamless process

Income Check

Optimise credit decisions and understand your customers’ true financial capacity by instantly verifying income using real-time data.

Risk Insights

Start assessing creditworthiness with real time, up-to-date and verified data giving unique insights into spending behaviours.

Money Manager

Build smart, intuitive personal finance management applications that give your customers tools and personalised insights to better manage their money.

Payments

Increase engagement and conversion by giving your customers a fully embedded payments experience – at a fraction of the cost.

Variable Recurring Payments

Smarter, faster recurring payments. VRPs are the new way to enable frictionless, real-time open banking payments.

What you get with Tink's tech

Plug-and-play through one API

Tap into our technology – on a single cloud-based platform – through one API integration.

No PSD2 license required

Using our ready-made authentication flows lets you operate under our PSD2 license.

Breadth and quality of data

We aggregate both PSD2 and non-PSD2 data through reliable connections to European banks and financial institutions.

Loved by developers

Our SDKs make it fast and easy to build great products

using our connectivity and data services.

Security you can trust

We’re an ISO 27001-certified company, and all customer

data is encrypted in transit and at rest.

Keep up with the latest

Want to stay on top of the news? Sign up for our newsletter and get our top stories delivered straight to your inbox.

2024-04-10

7 min read

Thomas Gmelch - how open banking can change the instant payment experience in Germany

Read more

2024-04-08

6 min read

How the Instant Payments Regulation will change the EU payments landscape

Read more

2024-03-07

6 min read

Smart moves with smart meters: how commercial VRP could support pay-as-you-use billing models

Read more

2024-02-20

5 min read

Billing and the cost of living: 2/3 of Brits want support from utility providers

Read more

2024-01-02

8 min read

2024 – what’s on the horizon for payments and data-driven financial services?

Read moreLending, levelled up

Our new white paper shows how you can elevate affordability assessments with enriched data.

Read more